Who Needs To File Boi 2025 Form. Both sides of the aisle wanted the boi. On or after january 1, 2025:

Starting january 1, 2025, certain u.s. This report can’t be filed through quickbooks or turbotax.

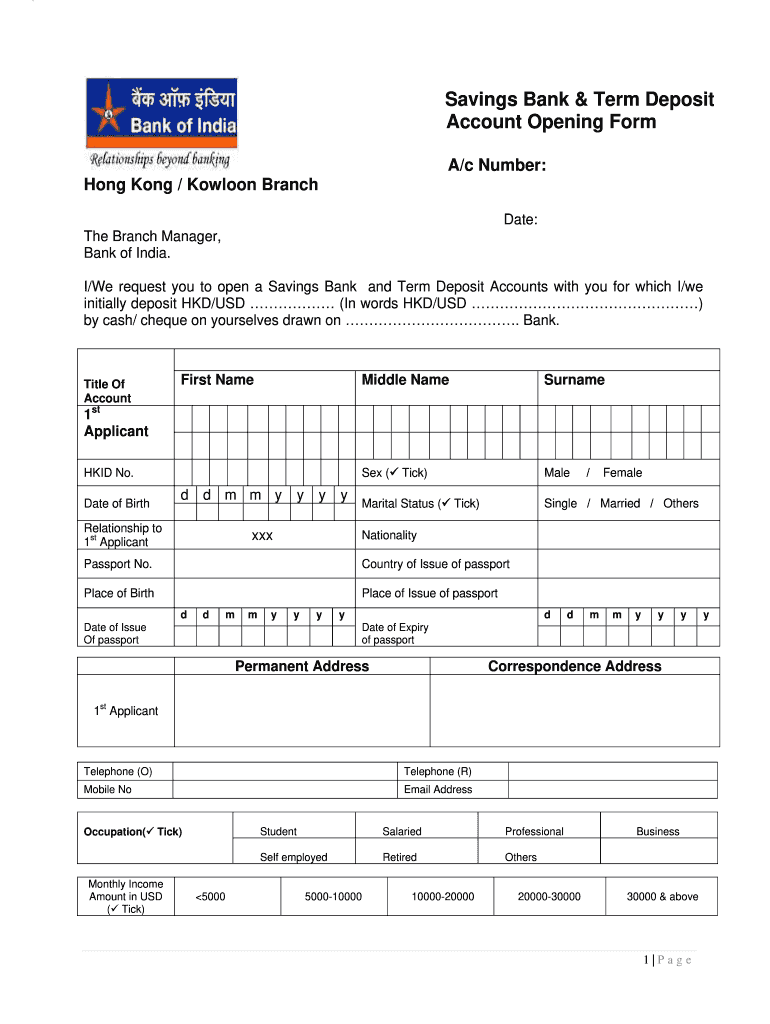

Boi form Fill out & sign online DocHub, New reporting companies created or registered on or after january 1, 2025, and before january 1, 2025, must file their initial boi report within 90 days of the entity’s formation.

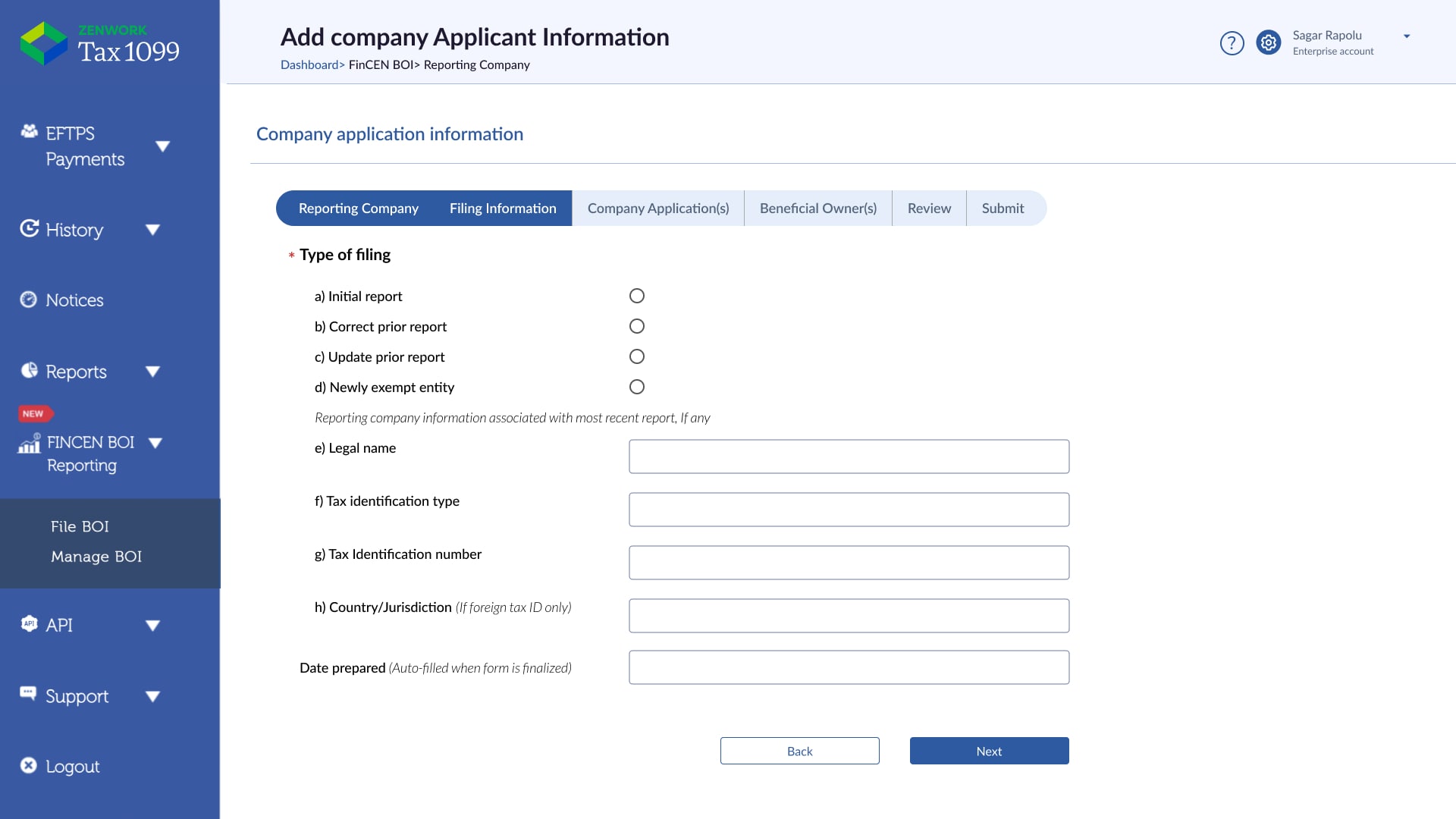

BOI Filing How to File BOI Report Online for 2025, Beginning january 1, 2025, certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial owners—the.

File BOI Reporting Online How to file BOI Report 2025 Tax1099, Essentially, all corporations, llcs and businesses that have filed formation documents with the secretary of state will need to take.

BOI Filing 2025 Individual Who Directly Files The Document That Creates Or Registers The, The rule describes who must file a boi report, what information must be reported, and when a report is due.

BOI Filing 2025 RLLC, Boi must be reported within 90 days after effectively receiving notice of your entity’s creation or registration (whichever is earlier).

HOW TO FILE BOI E FORM STEP BY STEP 2025 YouTube, Fincen began accepting reports on january 1, 2025.

BOI Filing 2025, Beneficial Ownership Filing, “your business will need to file the fincen boi report…one time.

BOI Filing 2025 What You Need to Know by EasyFiling Medium, Businesses will be required to submit a beneficial ownership information (boi) report.

The Corporate Transparency Act Navigating BOI Reporting in 2025 By FileForms Positive Change, Who exactly needs to file this form?